Table Of Content

- What Information Do I Need to Get Homeowners Insurance Quotes?

- Do You Want Actual Cash Value vs. Replacement Cost Coverage?

- The Cost to Rebuild Your House

- An example of comparing home insurance quotes

- What are the best home insurance companies?

- Homeowners insurance

- Will homeowners insurance cover a rental property?

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. QuoteWizard rated insurance companies based on their cost, discounts, coverages, financial strength, J.D. We used a weighted rating for each of these categories and scored them out of five. Although some states ban or limit insurance companies from using credit scores to determine rates, your credit score can greatly affect your home insurance premium in others.

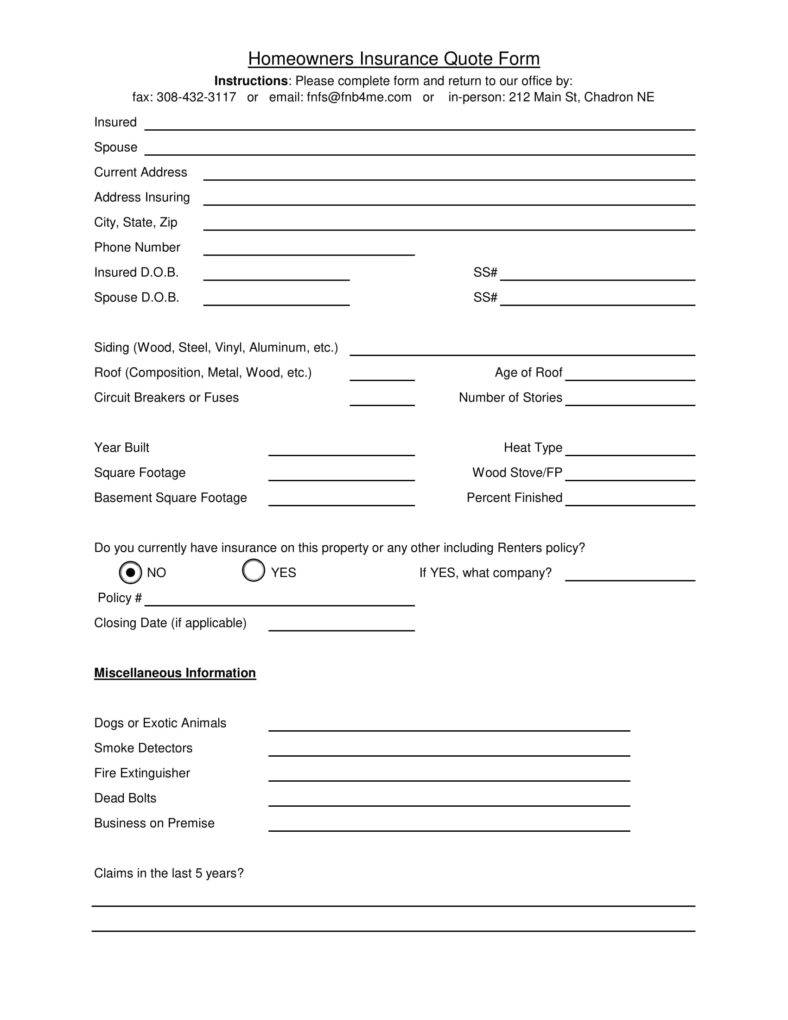

What Information Do I Need to Get Homeowners Insurance Quotes?

If you own a home and have a mortgage, your lienholder (the bank who is invested in your loan) will likely require you to carry insurance on your home. We often partner with banks to allow members to combine their insurance payments and monthly mortgage bill. Make sure your home is insured to at least 100% of its estimated replacement cost. These are sample rates and should be used for comparative purposes only. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. As a former claims handler and fraud investigator, Jason Metz has worked on a multitude of complex and multifaceted claims.

Do You Want Actual Cash Value vs. Replacement Cost Coverage?

A homeowners policy is insurance that protects you financially if a fire damages your home, someone steals your belongings or another catastrophe strikes. Mortgage lenders generally require you to buy homeowners insurance as a condition of your loan. To further customize your policy, you can add options such as identity recovery, service line protection and water backup coverage. Discounts are available for bundling your homeowners insurance with another Erie policy or installing burglar or sprinkler systems.

The Cost to Rebuild Your House

Ratings are based on weighted averages of scores in several categories, including financial strength, consumer complaints, coverage, discounts and online experience. While home insurance policies include several other coverages that protect everything from your personal belongings to liability, dwelling coverage has by far the biggest impact on your insurance premiums. The more of this coverage you have, the higher your rates will be. There are several online calculators that you can use to calculate your dwelling coverage limit, but most insurers should be able to provide you with an estimate when you get a quote.

We include rates from every locale in the country where coverage is offered and data is available. When comparing rates for different coverage amounts and backgrounds, we change only one variable at a time, so you can easily see how each factor affects pricing. Contact the home insurance company or your insurance agent to file a home insurance claim over the phone, through the company’s website, chat, email or app, depending on the company. You want to document the loss by providing information about the cause, when it happened and a list of what was lost. If you own one of these breeds the dog may be excluded from your liability insurance or you could be denied coverage altogether. NerdWallet typically recommends considering insurers with ratings of A- or higher.

Top 5 Homeowners Insurance Companies in Colorado 2024 - MarketWatch

Top 5 Homeowners Insurance Companies in Colorado 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

With availability in all states except two and a generous multi-policy discount, Progressive is the ideal insurance company for homeowners who have a car or other types of property to insure. Power’s 2022 digital experience study, indicating customer satisfaction with Progressive’s mobile and web experience. For an additional cost, you may have the option to upgrade your personal property coverage to replacement cost to ensure depreciation isn't subtracted from personal property claim payouts. We used data from Quadrant Information Services, a provider of insurance data and analytics. Rates are based on ZIP codes across the nation for varying coverage limits, deductibles and credit.

You could even get a discount on an ADT system and other smart home devices if you’re an American Family policyholder. This company, however, isn’t available in all states, so your eligibility may vary. Policy B provides more liability protection than Policy A. That means if you reach your liability limit of $100,000 with Policy A, you could be responsible for any additional out-of-pocket costs. Similarly, Policy B's dwelling coverage limit is higher, meaning your home's structure is protected for a larger amount. Yes, it’s worth your time to compare quotes even if you already have homeowners insurance.

Homeowners insurance

Insurers’ rates can vary considerably for the same coverage, so it’s good to compare quotes from at least three companies. Westfield has the lowest average prices among the top-scoring companies in our analysis. We also like its expanded dwelling coverage, including extended replacement cost and guaranteed replacement cost coverage.

Will homeowners insurance cover a rental property?

Shopping around for homeowners insurance quotes won’t affect your credit score. However, having poor credit is likely to elevate your rates in most states. For instance, say you’re leaning toward Company A but the price is a little high. If you like Company B but want the cushion of extended replacement cost coverage that Company A offers, ask whether you can add it. Most insurance companies will suggest a certain amount of dwelling coverage based on the specific features of your home, though you can often choose a higher or lower amount. Because each insurer has a slightly different way to calculate a home’s replacement cost, it can be tricky to figure out which dwelling coverage limit is most accurate.

Homeowners who prefer to manage their home insurance policy and financial products with one company may find Nationwide appealing, as well. Nationwide may not be ideal for you, though, if you’re more concerned with customer service than price. It scored lower-than-average in a study of customer satisfaction, according to J.D. And for a more personalized recommendation, you can refer to our list of the best home insurance companies for a variety of coverage needs and preferences. GEICO Homeowners insurance is a property insurance policy that provides coverage for your private residence. A homeowners policy typically covers losses and damages to a personal residence, as well as furnishings and certain other assets within your home.

Any company with an AM Best rating of B+ or higher has a “good” ability to meet its obligations in AM Best’s opinion. Companies with ratings below that may not be quite as safe a bet and often have higher rates of complaints relative to their size. To see whether previous customers have been satisfied, you can look at studies on homeowners insurance and property claims satisfaction from J.D.

Nationwide also stands out by offering ordinance or law insurance in its standard homeowners insurance policy. This means if you have a covered loss and need to update your home to meet current building codes, your insurance may cover the costs. Depending on which type of policy you choose, Country Financial may cover household mishaps, such as countertop burns or spilled paint. In most states, Country Financial offers guaranteed replacement cost coverage that pays the cost of standard new construction materials and labor if you need to rebuild your home, with no limits. Shopping around is the best way to find the cheapest home insurance quotes you can, but you can also try these other tips to find lower homeowners insurance rates. When it comes to price, Company C wins — but that’s because you’re getting significantly less coverage for the structure of your home and your personal belongings.

Those upfront savings might not be worth it if a house fire would leave you without enough insurance money to rebuild. Once you have your quotes on hand, it’s time to go over them with a fine-toothed comb for accuracy. Review the documentation you receive and ensure that each home insurance quote is in line with the information you provided. Your coverage amounts may vary based on each insurance company’s valuation tool, but as long as your quotes are in the same ballpark, you should be able to compare them. Even if you already have a home insurance policy in place, you might consider shopping around on occasion to make sure you're getting the coverage and customer service you need at the best price. You might consider comparing quotes if your coverage needs have changed, you're not satisfied with the level of service with your current carrier or you think you could get a better rate for the same coverage.

Experts recommend collecting between three and five home insurance quotes to better gauge what your policy will really cost. Just because something is excluded from your home insurance policy does not mean you can’t be covered for it, though. Home insurance providers sell separate endorsements for earthquakes, floods and other perils to protect your home further.

No comments:

Post a Comment